Cut 30% of Ops Costs with a Free Strategy Sprint

Funds & PE

Accelerating value creation through strategic digital transformation that enhances portfolio performance and investment intelligence.

Overview of the Market

The private equity and investment fund landscape has evolved dramatically, with global assets under management exceeding $7 trillion. As competition for quality deals intensifies, leading firms are increasingly leveraging technology to gain competitive advantages in sourcing, diligence, value creation, and exit planning. Data analytics, AI, and digital transformation have become critical differentiators, enabling superior investment decisions, operational improvements in portfolio companies, and enhanced reporting capabilities for limited partners. The most successful firms now view technology not merely as a support function but as a strategic asset that drives returns.

Industry Problem

Despite recognizing technology's importance, many investment firms struggle to implement effective digital strategies. The industry faces unique challenges: fragmented data across portfolio companies, inconsistent reporting frameworks, and the need to rapidly assess and improve operations across diverse businesses. Traditional approaches to technology often fail to deliver actionable insights or measurable value, with over 70% of digital initiatives falling short of expectations. Meanwhile, the pressure to demonstrate clear value creation beyond financial engineering continues to grow, requiring more sophisticated approaches to operational improvement and performance tracking.

Future Works’ Solutions

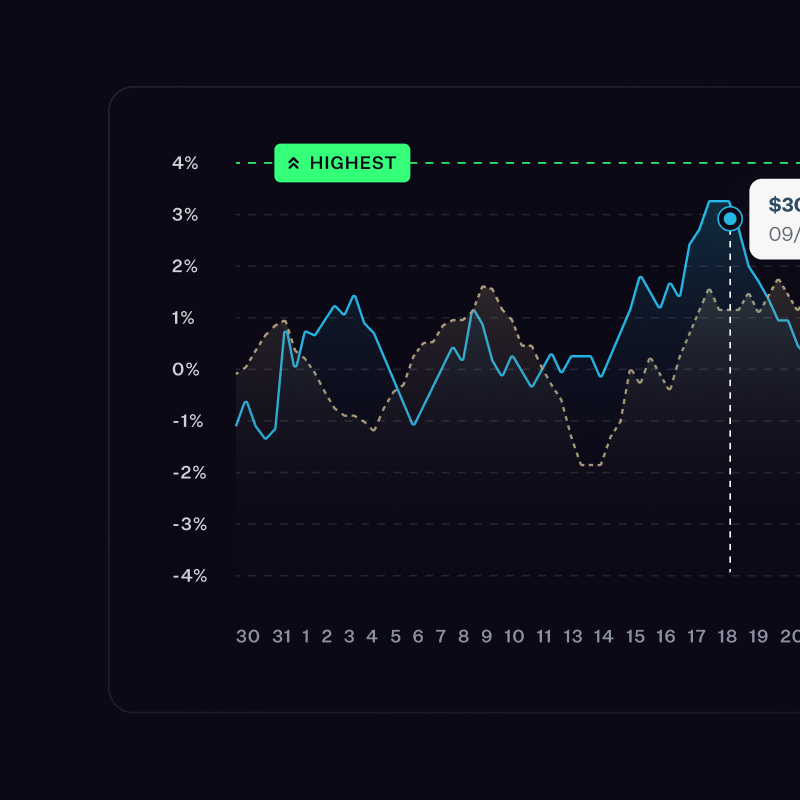

Future Works partners with investment leaders to implement next-gen digital transformation that directly impacts investment performance and operational efficiency. Our approach focuses on creating immediate value through targeted solutions that enhance deal sourcing, accelerate due diligence, optimize portfolio operations, and improve investor reporting. We help investment firms build composable technology ecosystems that provide comprehensive visibility across their portfolio while enabling rapid deployment of proven operational improvements to portfolio companies. By combining AI-powered analytics with practical implementation expertise, we ensure technology investments deliver measurable returns throughout the investment lifecycle—from identifying promising targets to maximizing exit valuations.

Our Work

Deep expertise in your industry.

We have deep experience working with pioneering companies in technical and real world asset industries, where we see the biggest opportunity to leapfrog with AI-powered custom software solutions.

.png&w=1920&q=75)